By Jason Greenberg, MD

Edging out poor commercial payer behavior and the continuous issue of declining Medicare reimbursement rates, the workforce crisis is now considered by many practice leaders to be the most significant challenge in anesthesia practice.

Workforce challenges are an issue across healthcare, of course, with the American Hospital Association reporting serious staffing issues expected to persist for the next decade. However, conditions are particularly acute in anesthesia, where a confluence of factors is working together to continue to strain the system.

The Anesthesia Workforce Challenge Explained

These are a few of the critical issues that make Anesthesia staffing so complicated:

- Anesthesia services are delivered by a diverse workforce that includes physician anesthesiologists, Certified Registered Nurse Anesthetists (CRNAs), and more recently, Certified Anesthesia Assistants (CAAs) that require a long training runway to get up and running. Mixing and matching the three provider types can be complex due to variations in salary, reimbursement, the types of procedures each is best suited to, supervision requirements, and other factors.

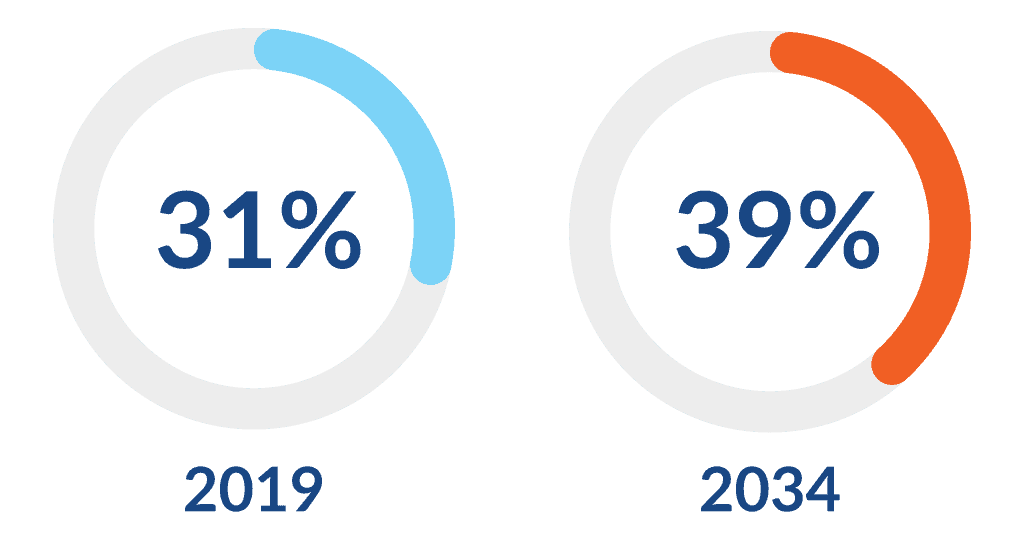

- Demand for anesthesia services is increasing exponentially as the population ages and surgical procedures become more complex. By 2030, the number of U.S. residents 65 and older will increase 55%, and their proportional demand for surgical services will increase from 31% to 39% by 2034. Overall, across populations, demand for surgical services is expected to increase up to 3% per year over the next decade.

- Amid rising demand—and despite an increase in the number of anesthesiologists, CRNAs and the emergence of CAAs—anesthesia is experiencing a significant provider shortage. Many seasoned anesthesiologists and CRNAs retired during the pandemic, and more than half of practicing anesthesiologists are older than 55. The Health Resources & Services Administration (HRSA) predicts that the U.S. will be short 8,450 anesthesiologists by 2037.

- The workforce shortage has spurred a rise in the locum tenens market, which is raising staffing costs across the board and siphoning funds away from providers employed under traditional agreements in both hospitals and independent practices. According to the American Hospital Association, U.S. hospitals spent more than $51 billion on contracted staff in 2023, and expensive contract labor is a major reason why hospital labor costs increased by more than $42.5 billion between 2021 and 2023. In 2022, nearly 30% of healthcare facility managers reported staffing locum tenens anesthesiologists or CRNAs within the prior year.

- Complexity is also being fueled by the expansion of non-OR procedural sites. Anesthesia providers are increasingly delivering services in settings such as GI, cardiac catheterization, electrophysiology, and interventional radiology suites, supporting a large range of complex and growing procedures. Here, anesthesia providers are contending not only with increased demand for services, but also with the inefficiencies that arise when those services are no longer delivered in a centralized location.

The Solution: Effective RCM

What makes the workforce crisis particularly daunting is that it appears to be a market force over which anesthesia practices have little control.

Fortunately, there are many ways practice leaders can mitigate—and even counter—the effects of the workforce crisis. We see time and again that multiple levers can be used to optimize a practice that faces this challenge.

Effective Utilization

Efficient anesthesia staffing is a complex puzzle, mapping procedure, acuity level, and facility type to the most appropriate provider. It doesn’t have to be a guessing game.

Accurate procedure data helps practices reliably determine how to optimize the staffing resources available. Effective utilization can stretch thin staffing resources further, with the bonus effects of improving reimbursement per full-time equivalent (FTE) and decreasing the risk of attrition by helping ensure extra financial benefit for hours worked. The right balance of utilization can also benefit the health system facility by optimizing their staffing resources, which leads to stronger partnerships.

Differentiation in Recruiting

Recruitment and retention are key components of navigating the challenging workforce environment. This starts by developing a strong culture and ensuring adequate renumeration for services rendered. As a Ventra Health client recently noted, there is no better recruiting tool in a buyer’s market than a strong revenue cycle. Effective RCM delivers the most important value proposition for a prospective colleague: Confidence in their earning potential and knowledge that the work they perform will ultimately lead to payment.

“Feeling confident about compensation affects the daily life of our providers, and it’s a big part of the culture of a group,” the managing partner explained. “When potential new colleagues hear positive feedback from our current anesthesiologists about the business side of our practice, that really helps set us apart from other groups.”

Strength in Subsidy Negotiation

With Medicare reimbursement at less than 33% of commercial payments, and commercial payments facing headwinds, hospital subsidies make up for reimbursement shortfalls and have become critical components of an anesthesia group’s overall operating revenue. Subsidies need to be reviewed and renegotiated frequently to ensure they keep pace with cost-of-care projections and continue to address the practice’s financial need.

Reliable data is the backbone of effective negotiation. Accurate reimbursement and cost data from an RCM partner will help practices confidently arrive at a defensible number that they can be assured will cover their needs. Most practices also find that strong, transparent data has a halo effect, improving long-term relationships and attitudes toward future negotiations between facilities and provider groups.

Improved Reimbursement

At one time, effective RCM was not the focus for most thriving anesthesia practices. Margins were high on commercial payments, and practices could direct their attention elsewhere. In addition, RCM was simpler, with far fewer complexities than exist in the present-day market. It was easier to set it and forget it.

This approach does not work today, and having an RCM partner that can navigate the challenging waters with a data-driven approach is key. Sophisticated analytics proactively prevent denials, streamline billing processes, shorten the time it takes to receive payment, and increase the amount collected. An optimized revenue cycle ensures the practice not only maintains its financial strength amid staffing issues but continues to grow.

How Ventra Can Help

Ventra Health is uniquely committed to delivering the data and professional expertise to guide practices through the anesthesia workforce crisis. We take a white-glove approach to client success, going beyond basic billing and coding to deliver the customized consultative services that protect medical practices from severe market challenges.

With more than 40 years’ experience maximizing revenue for anesthesia and other facility-based physician specialties, our teams are immersed in all the nuances that make anesthesia staffing so complex. They leverage vSight™, our powerful data & analytics platform, to generate reimbursement, cost, utilization, and procedure data to improve revenue and support optimal staffing decisions. They are also recognized experts in contract negotiations, ensuring our clients have seats at the table and positions of strength from which to negotiate favorable terms with payers and facilities.

The workflow crisis in anesthesia has extremely personal implications, with half of anesthesiologists and CRNAs feeling overworked and burned out. Fortunately, our hands are not tied. We can improve working conditions and strengthen our practices by focusing on the essentials, which include a strong RCM partner.

About Jason Greenberg

Jason Greenberg, MD, is EVP and Chief Commercial Officer at Ventra Health and a practicing cardiothoracic anesthesiologist. Prior to his role at Ventra, he was President and CEO of Anesthesia Care Associates Medical Group, a large independent medical practice in San Francisco. He has also served as President/CEO of Northern California Anesthesia Physicians and in several clinical leadership roles in the Sutter Health System. Dr. Greenberg serves on multiple committees at the American Society of Anesthesiology, including the Committee for Practice Management, and is a member of the Perioperative Advisory Board of GE HealthCare.