The Centers for Medicare and Medicaid Services (CMS) recently released the CY 2026 Physician Fee Schedule (PFS) Final Rule, which includes updates to the Quality Payment Program (QPP), the Merit-based Incentive Payment System (MIPS), practice expense methodology, telehealth reimbursement, and more.

The key takeaway for Hospital Medicine: The 2026 changes will negatively impact RVUs for Hospital Medicine, which in turn will negatively impact reimbursement by 5% to 7%. Although CMS has increased the Conversion Factor (CF) for 2026, it will be offset by changes to RVUs and a rebalancing in practice expense methodology.

The following summary provides the detail behind those conclusions, as well as the specifics on how changes in the final rule will affect hospitalists and their practices.

Physician Fee Schedule

The CY 2026 Conversion Factor (CF) increased for the first time in six years, but not by as much as suggested in the proposed rule. The final CY 2026 CF is $33.4009 for most physicians, which represents a 3.26% increase over 2025. New this year, CMS finalized a separate CF of $33.5675 for physicians participating in Advanced Alternative Payment Models (APMs), which is 3.77% more than the 2025 rate.

The increases are based on three factors:

- A statutory increase in the Medicare Access and CHIP Reauthorization Act (MACRA) of 0.25% for non-APMs and 0.75% for qualifying APMs

- A 0.49% positive budget neutrality adjustment

- A 2.5% one-time payment boost from the One Big Beautiful Bill Act

Efficiency Adjustment

CMS is imposing a -2.5% efficiency adjustment that will cut RVUs for non-time-based services and will offset some of the CF benefits for Hospital Medicine providers and groups. The adjustment applies only to procedures and does not impact Hospital Medicine Evaluation & Management (E/M) codes.

CMS believes that current reimbursement rates may not reflect efficiencies gained by recent technological and operational improvements in care delivery. The efficiency adjustment, based on a five-year review of Medicare Economic Index (MEI) productivity data, is intended to correct for the issue by lowering work RVUs and making corresponding updates to the intraservice portion of physician time inputs for certain services. CMS will apply the efficiency adjustment to work RVUs every three years, which will further decrease work RVUs cumulatively over time.

Practice Expense Methodology

Changes to the Practice Expense (PE) portion of RVUs will also impact revenue for hospitalists and other facility-based physicians. CMS is changing the way it allocates indirect PE RVUs, which reflect the administrative overhead of running a practice. (Direct PE RVUs were already calculated differently for facility-based physicians.) CMS believes the current methodology of allocating the same indirect PEs to both facility-based and non-facility-based physicians is outdated and doesn’t factor in the rise in employed physicians. The CY 2026 final rule reduces indirect PE RVUs in the facility setting to half those for the non-facility setting.

This change obviously impacts reimbursement for hospitalists. Critically, it will also impact compensation for practices that pay clinicians based on total RVUs, as a reduction in indirect PE RVUs will bring down total RVUs.

The Cumulative Effect on Revenue

Again, we expect the overall effect of these three changes to negatively impact revenue for hospitalists by 5% to 7%, depending on their mix of procedure and E/M codes. The benefit hospitalists and groups will get from the general CF increase will be offset by both the efficiency adjustment and the rebalancing of indirect PE RVUs.

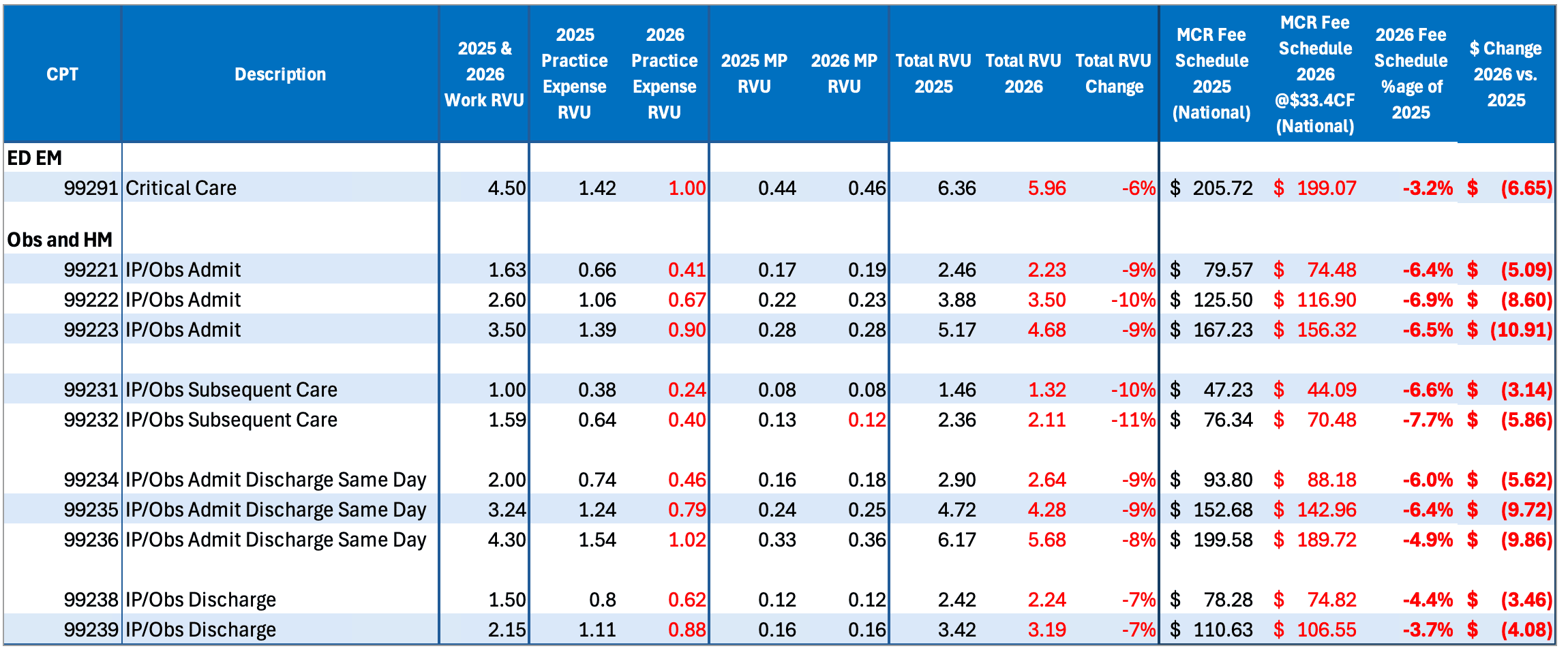

The following chart shows the specific impact to Hospital Medicine and Observation CPT codes:

Telehealth Reimbursement

CMS has streamlined telehealth service review, removing the distinction between provisional and permanent telehealth services and focusing only on whether the services can be delivered via two-way, real-time audio-video technology. CMS permanently added ED E/M codes (99281-99285), Critical Care, and Observation services to the Medicare Telehealth Services List, and it has removed frequency limits on telehealth for inpatient, nursing facilities, and critical care visits. Virtual supervision is now permanently allowed for services requiring direct oversight.

Teaching Physician Supervision

CMS ended virtual supervision policies in urban areas after December 31, 2025, requiring teaching physicians to be physically present with residents during key parts of care. However, virtual supervision in teaching settings is now permanently permitted when the service itself is furnished virtually.

Direct Supervision

Direct supervision may be met via real-time audio-visual communication (not audio-only) for applicable incident-to services, diagnostic tests, pulmonary rehabilitation, cardiac rehabilitation, and intensive cardiac rehabilitation. This does not include services with global surgery indicators 010 or 090.

QPP and MIPS

CMS remains committed to the Quality Payment Program (QPP) and the Merit-based Incentive Program (MIPS), and they have made few substantive changes to the program.

Here’s what hospitalists need to know:

Performance Thresholds and Category Weighting

- The MIPS performance threshold will remain at 75 points through CY 2028.

- The data completeness threshold will remain at 75% for the MIPS Quality Performance Category through the CY 2028 performance period, possibly rising to 80% in CY 2029.

- There are no expected overall changes to the 2026 weighting of the four reporting categories: Quality, Improvement Activities, Cost, and Promoting Interoperability. However, qualifying for a Special Status (small, non-patient-facing, etc.) will continue to affect the weighting of categories for individuals or groups. Check your Special Status when it becomes available in December 2026 to see what may be re-weighted.

- Eligibility criteria for individuals will remain the same for 2026.

Quality Category Updates

CMS re-evaluates the list of quality measures annually. Although the final list for 2026 makes several changes relevant for other specialties, the list remains unchanged for Hospital Medicine and includes just four measures:

- QID5: Heart failure (HF): Angiotensin-Converting Enzyme (ACE) Inhibitor or

Angiotensin receptor Blocker (ARB) or Angiotensin Receptor Neprilysin Inhibitor (ARNI) Therapy for Left Ventricular Systolic Dysfunction (LVSD) - QID8: Heart Failure (HF): Beta Blocker Therapy for Left Ventricular Systolic Dysfunction (LVSD)

- QID47: Advance Care Plan

- QID130: Documentation of Current Medications in the Medical Record

In addition to these measures, Ventra Health recommends that clients also report on the following:

- HCPR24: Appropriate Utilization of Vancomycin for Cellulitis

- HCPR29: Avoidance of DVT Ultrasound for Patient Diagnosed with Cellulitis

Promoting Interoperability

PI is voluntary for most hospital-based physicians and groups, and their categories are automatically re-weighted to omit PI. However, PI scores are typically high and can offset lower Quality measures when contributed toward your final score. We recommend contacting hospital IT to request a PI report for 2026, ideally by September 2026.

MIPS Value Pathways (MVPs)

CMS is signaling that MIPS Value Pathways (MVPs) will be important in the future, with six new MVPs proposed for 2026: Diagnostic Radiology, Interventional Radiology, Neuropsychology, Pathology, Podiatry, and Vascular Surgery.

While there is still no Hospital Medicine MVP at this time, there are disease-specific MVPs that hospitalists and groups may elect to report on. Your reporting partner can help you evaluate and select your best options.

Next Steps

The Ventra Health team is committed to providing the support and guidance you need to make the best decisions for your practice. For specific analysis on how these changes will impact your reimbursement and revenue, please reach out to us.

Read more about the CY 2026 Medicare Physician Fee Schedule Rule on the CMS Fact Sheet.